3. Ecosystems

Despite the impressions through the media, startups don’t achieve success overnight. This is even more true for hardware startups, most of the long upfront development leading to the launch day often hidden from the general public. Also despite the popular belief, startups operate within an ecosystem, and their success and failure depends on their skill of choosing the right partners and tools as well!

In this chapter we look at the current hardware startup ecosystem, with more detailed discussion on the features that are dominating today’s trends.

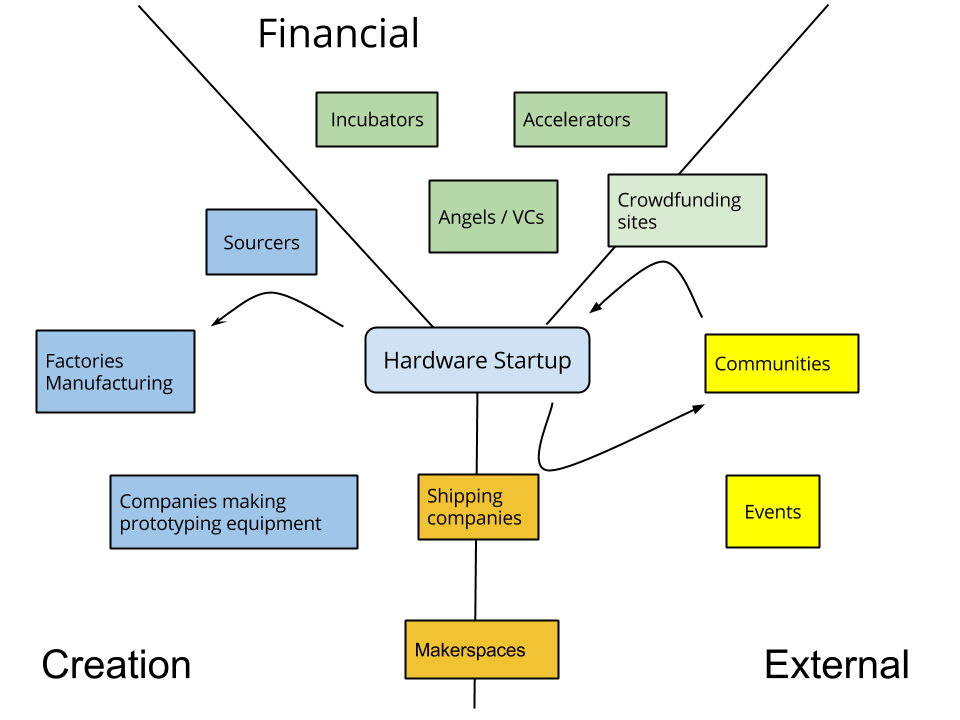

We divide the ecosystem into three main areas: financial, creation, and external.

Finance

The financial area concerns with supporting the startup on its path from an idea to profitable business.

This includes traditional angel investors and venture capital, though many investors are just figuring out their modus operandi in the hardware space, what they consider signs of a potential large hit in hardware. To complement their support, crowdfunding sites let startups leverage a large global community of potential customers. Finally, there are the incubators and accelerators that provide some low level funding uniformly to the startups that take part in their program, as well as mentoring and access to an investor network to facilitate further funding.

Creation

Ecosystem players in the creation section affect how the hardware products get made.

This includes companies that are making prototyping tools to get the first idea into a workable form. The more different prototyping tools are available, the lower the barrier to entry at the very low level.

Factories and general manufacturers are the places where the products actually get made. Not every geographical area is equally good to do the same things, illustrated by the example of Shenzhen, China taking over most electronics manufacture. These players can help startups to create great things fast, but startups that choose their manufacturing partner badly can face failure very quickly. The process of finding the factory must involve selecting one has the right skill set, has the right match for the startup’s product volume, and has a good track record. A lot potential improvements in hardware product development can be achieved by helping manufacturers and startups be closer to one another. This convergence can be brought about geographically by higher level economical incentives of industry development. On the practical level sourcers and match-makers can facilitate in most cases.

External

The external section is about the partners that interact with the startups out in the public.

There are a large number of events that provide publicity to startups, including pitching, promotion, hackathons, and meetups. Many of these tap into existing communities, though startups do need to build their own communities as soon as possible.

Crowdfunding bridges the gap between communities and the startups funding needs. Makerspaces are a connection between communities and product development. Shipping companies and distributors are also invaluable partners that make the last mile connection between the startup’s product and their customers.

3.1 Crowdfunding

Introduced earlier in this report, crowdfunding is a very important development supporting the rise of hardware startups. Creating hardware products requires significant amount of capital, and crowdfunding spreads the risk of raising that capital over a larger number of people instead of the traditional way of small number of investors.

The two most dominant Crowdfunding websites are Kickstarter and Indiegogo.

Kickstarter is open for US-based teams only, and its focus allowed it to become the largest player for the US consumer market.

Indiegogo took an international path, and it’s more inclusive for projects by not filtering them. Indiegogo’s recent InDemand service is directly improving hardware campaigns by providing a pre-order page for successful, finished campaigns, so they can continue to acquire users while their product is being made.

Other large players are for example Crowdsupply, a hardware focused crowdfunding site, and flyingV that is focusing on Asian-based teams.

Kickstarter’s 2014 report shows that while 5% of all projects were in Technology (1,124 of the total of 22,252), almost 23% of the funds raised were for these projects, which translates to $111,209 raised for each successful technology campaign.

Based on crowdfunding industry reports, 2013 has seen $6.1 billion raised globally through crowdfunding, a number which has grown to $16.2 billion in 2014, and will likely hit above $34 billion in 2015. This suggest at least about $8 billion available this year for hardware projects across the world through crowdfunding.

Trends

The key trends that indicate further growth of crowdfunding:

- growing user base, more people will back their first projects

- more crowdfunding sites1

- more projects, both earlier stage and more sophisticated

- more “serial crowdfunders”: teams with more than one successful campaigns

Based on the experience of successful campaigns so far, hardware startups can improve their share of funds and probability of success by doing good foundation work before their campaigns, start to build their community as early as possible, delivering their products well and on schedule, and engaging their community (users, possible partners, distributors) every step along the way.

Equity Crowdfunding

An alternative to the rewards-based crowdfunding above is equity crowdfunding, where a team is looking to raise money for their organization directly. Equity crowdfunding has its own challenges, especially regulatory difficulties. The financial regulators of in different countries have different opinions and plans for the future of alternative fund-raising. Most countries haven’t addressed equity crowdfunding yet, while those that addressed range from Singapore where its practice is illegal, through Australia where there are proposals to make it available, all the way to New Zealand which has legal framework since 2013 supporting it.

3.2 Incubators and Accelerators

Incubator and accelerator programs usually help early stage companies to succeed. Most of the time this help takes the form of:

- participant selection process based on demonstrated results

- a fixed length program (few months)

- funding in return for equity in the company

- mentorship & networking opportunities

- demo days to pitch to further investors

The aim of these programs is to increase the success probability of good teams and to teach them how to build companies using all the tools and skills available nowadays. Because of this, most programs were started by industry veterans with large technical and financial networks as well as plenty to teach to the up-and-coming teams.

The number of incubators and accelerators increased markedly in the recent years, since the bootcamp-style model of these programs is relatively straightforward, and because business experts, large companies, governments are all looking to discover the companies creating the Next Big Thing. The share of hardware startups participating in these programs is also increasing, and there are also accelerators focusing on hardware products only.

Still, the development of Asian accelerators is far behind their US counterparts, both in number of companies graduating from them, as well as the total amount of investment in companies going though the program.

There are a number of notable hardware accelerators in the Asia Pacific region.

Hax is an accelerator with offices in China, Singapore, US, and has more than 250 founders and 50 mentors. They work with startups on their prototyping, development, manufacturing, supply chain skills, right at the source of global hardware manufacturing.

Lemnos Labs, based in San Francisco invests in early stage hardware startups, especially in the aerospace, robotics, transportation, agriculture, and Internet of Things areas.

The IdeaSpace Foundation is a non-profit organization in the Philippines to spur technology entrepreneurship in the country, providing very early stage incubator program for many different areas of technology.

Since both the current hardware startups and hardware accelerators are following a new development model, most people involved are learning along the way from the successes and failures encountered. It is likely more hardware-focused accelerators will emerge in the near future, at diverse locations, and differentiating from each other to provide more value to the startups.

3.3 Getting help with hardware

Another group of non-traditional accelerators are companies providing help for startups in the product creation process, and staying out of the business side of running of a company. They can be described as specialized engineering and logistics consulting groups with unique knowledge for early stage product development.

One of the notable examples is HWTrek, a hardware development and expert-matching platform in Taiwan. They connect teams that have ideas, with experts that can solve their specific problems. HWTrek is also promoting first hand manufacturing experience and supplier match-making by bringing global startups to Taiwan and China with their Asia Innovation Tour. The premise is that with help startups can shorten their development time and avoid costly mistakes down the line by taking manufacturing into the account from the very beginning.

Another firm is Dragon Innovation, which targets teams that are planning to launch a crowdfunding campaign for their hardware product. They review the product design, manufactuability, and give advice. Based on the results of the feedback they also provide a seal-of-approval to help the teams’ future crowdfunding campaign, as the potential backers can be more certain about the feasibility and quality of the promoted product.

The common issue teams are trying to solve through these programs is going from 1 prototype to 100 to 500 products. Many factories are not well suited for these intermediate numbers, and partners like HWTrek and Dragon Innovation can bridge that gap through their networks.

For some niche areas, such as electronics, a number of companies are providing solutions already. Seeed Studio’s Fusion service provides a platform services around prototypes in the 10-300 units range: printed circuit boards (PCB), stenciling, and PCB assembly. Their Propagate service takes this to the next level of 100 to 10,000 units, with device assembly, testing, and drop shipping. These services bring Shenzhen’s manufacturing skills and power to anyone around the world, significantly lowering the barrier of entry for electronics products.

CircuitHub is a similar electronics manufacturing service, directly targeting hardware startups, with the goal of scaling from 1 unit to 10,000 with the least amount of effort. They mix the lessons learned from software startup regarding great service and powerful user interfaces, bringing it to facilitate hardware work.

In the future, similar services will likely target other aspects of the hardware manufacturing process, further lowering the barrier for more sophisticated products.

3.4 Makerspaces

Makerspaces (also called hackerspaces) are communities built around public workshops to share tools and knowledge, and facilitate all kinds of learning and creating. They are very successful breeding grounds for hardware startups. The community aspect facilitates a more bootstrapping style development (as opposed to getting an investment), which might make them slower growing than other startups for example going through accelerators, but often result in deeper hardware knowledge and more useful personal networks within the community.

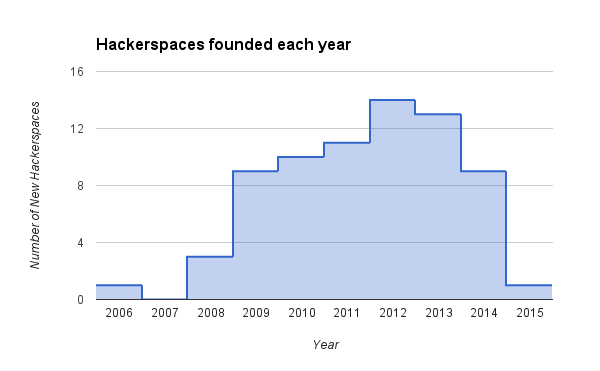

At the time of writing there were 71 active makerspaces on the Hackerspaces Wiki in the Asia-Pacific region. China and Australia had the most spaces listed, though the list is likely not exhaustive on the page.

Their popularity really rose around 2009, together with increased global exposure of initiatives like Maker Faire around that time. Maker Faire is an event where DIY and hardware creators show off their inventions and creativity. The Asia-Pacific region has at least 16 Maker Faires at different locations, and many of them experienced tremendous growth in the last couple of years. This shows the much wider acceptance of tinkering, maker culture, and hardware creation.

The trends point at new makerspaces being created continuously, though not necessarily in an increasing rate. The biggest gains in the near future are likely not in the number of spaces, but the size of their communities, the number of people who frequent makerspaces. Since the amount of knowledge available is connected to the number of people in the community, this is a good sign for creating and supporting the makers of the future. As more startups will emerge from makerspaces, they are more likely to feed back to their communities too, and provide a powerful “alumni” network, similar to the more formal programs of the accelerators.

3.5 Countries

The background of different countries is also an important aspect to consider, as they wary a lot across the region. On the Bloomberg Innovation Index 2015 that ranked countries by R&D spending, manufacturing, number of hi-tech companies, education, research personnel, and patents, there are 3 Asia-Pacific countries in the Top 10 in the overall ranking: South Korea at No 1, Japan at No. 2, and Singapore at No 8, with five more countries further down in the Top 50. This shows that Asia-Pacific has a large variation, having both the leaders and many of the laggards in innovation.

One of the most crucial decision an early stage startups can make is where to set up their operation. It will determine quite a long way into their development their access to resources such as:

- skilled talent (both young and industry veterans)

- manufacturing infrastructure

- affordable living and office space

- high quality services such as banking, shipping, administration

- inspiring ecosystem of existing startups

- culture of support and encouragement of entrepreneurship

In today’s world an increasing number of people spend a large part of their lives away from their birth country, and this mobility must results in good communities getting better by the immigration, and uncompetitive locations falling even more behind without an intervention.

- Crowdfunding is in the top 15 fastest growing investments with 72% year-on-year growth last year↩