Conclusion - Get Smart !

Enhancing your investment strategy

When we set out to build Stockopedia’s new Smart Money tools, it quickly became clear that we had an immense task on our hands. There was a huge and unwieldy new data set to learn about. Then it had to be developed into tools that our subscribers could use and love. But it wasn’t just a case of plugging in a range of new services. We had to grapple with precisely where the most important nuggets of information were. We had to determine what this data could tell us and how our subscribers could profit from it.

Ultimately, those questions meant looking for research that until now has been the preserve of market professionals. Sure, many of us are already conscious of the actions of smart money investors. We might hang on the words of research analysts, wonder at the buying and selling of company directors and fund managers and be struck by fear of short sellers. Heck, a few of Stockopedia’s screening tools already look for some of these signals. But what we found when we put it all together was a set of smart money signals that are proven to influence share prices. That means they can improve your investment returns.

It starts with a process

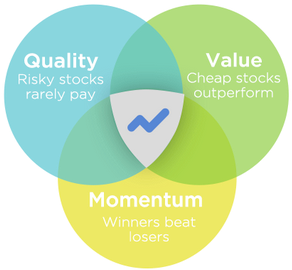

At the heart of everything we do at Stockopedia is a belief in sound investment styles based on what actually works in stock markets. The strongest forces influencing share prices are ‘Value’ and ‘Momentum’ - better known as ‘cheapness’ and ‘share price strength’. The prices of stocks, sectors and indices tend to trend in a single direction, but eventually greed or fear ensures that they overshoot. Investing with momentum captures the trend, while investing for value captures or defends against the overshoot.

Academics and traders have shown that a share portfolio built using a blend of these principles has beaten the market over almost all time frames. James O’Shaughnessy, in his famous book “What Works on Wall Street”, showed that a portfolio of Trending Value stocks has been the best performing strategy over the last 40 years. Meanwhile the quants at AQR Capital have published astonishing research titled “Value and Momentum Everywhere” which illustrates the perpetual outperformance of the strategy. Not only does this blended approach outperform, but it does so at almost half the risk of using either strategy alone.

Smart Money boosts profits

So what happens when you add Smart Money to the mix? A classic example of the impact of overlaying Smart Money signals to a sound Value and Momentum strategy was shown in a 2008 research paper titled “Some Insiders Are Indeed Smart Investors”. While the study didn’t include transaction costs it found that further filtering Value and Momentum shares for Insider trades resulted in a 23.7% annualised performance between 1995 and 2008, an astonishing result.

The principles of Value and Momentum make up the core axis of the Stockopedia StockRanks system. By incorporating Quality these systems help guide investors into sound capital allocation decisions. By incorporating confirmatory signals from Smart Money Rankings investors can take these principles even further. Whether you are a ‘hunter’ (stock picker) or a ‘farmer’ (systematic investor) you can build Smart Money signals into your investment routine.

For the stock picking ‘Hunters’

Hunters are much more active in daily stock markets, seeking to invest more nimbly and select individual stocks for their portfolio. If this is your style, try scanning lists of stocks daily or weekly that are showing evidence of insider buying, high conviction fund manager bets or strong earnings momentum. Finding standout quality, cheap, moving stocks that are showing Smart Money backing can be a huge confirmatory signal. Act quickly in these scenarios and you could find a rare market gem.

For the rule based ‘Farmers’

Farmers tend to rely on periodic stock screening to highlight portfolios of shares worth buying. Screens can be built according to sound investment principles but taken further by incorporating Smart Money rankings. The great benefit of using rankings as criteria in screens is that one can discover stocks showing the general, rather than specific signs of Insider, Institutional or Analyst backing. The easy to use Stockopedia Insider Rank, Best Ideas Rank and Earnings Momentum Rank can be added as overlays to a traditional value/momentum screen to filter candidate stocks further.

For illustrations of the application of these principles as well as a variety of ready to go screens please do check out the tools at www.stockopedia.com. We aim to make the best investment processes completely available wherever you are.

Hope to see you online soon!

Ed and Ben

- Giamouridis, Daniel, Manolis Liodakis, and Andrew Moniz. “Some insiders are indeed smart investors.” Available at SSRN 1160305 (2008).↩

- Gregory, Alan, Rajesh Tharyan, and Ian Tonks. “More than just contrarians: insider trading in glamour and value firms.” European Financial Management (2011)↩

- Seyhun, H Nejat. “Insiders’ profits, costs of trading, and market efficiency.” Journal of Financial Economics 16.2 (1986): 189-212.↩

- Leonard Zacks “The Handbook of Equity Market Anomalies” 2011. 25 Feb. 2014↩

- Lakonishok, Josef, and Immoo Lee. “Are insider trades informative?.” Review of financial studies 14.1 (2001): 79-11.↩

- Barber, B. “Can investors profit from the prophets? Analyst recommendations and stock returns” 2010.↩

- Jegadeesh, Narasimhan et al. “Analyzing the analysts: When do recommendations add value?.” The Journal of Finance 59.3 (2004): 1083-1124.↩

- Womack, Kent L. “Do brokerage analysts’ recommendations have investment value?.” The Journal of Finance 51.1 (1996): 137-167.↩

- McKnight, Phillip J, and Steven K Todd. “Analyst forecasts and the cross section of European stock returns.” Financial Markets, Institutions & Instruments 15.5 (2006): 201-224.↩

- Jegadeesh, Narasimhan, and Joshua Livnat. “Revenue surprises and stock returns.” Journal of Accounting and Economics 41.1 (2006): 147-171.↩

- John Shon “Trading on Corporate Earnings News” 2011. 25 Feb. 2014↩

- Cohen, Randy, Christopher Polk, and Bernhard Silli. “Best ideas.” Working paper. Harvard Business School (2010)↩

- Baks, Klass, Jeffrey A Busse, and T Clifton Green. “Fund managers who take big bets: Skilled or overconfident.” Woring paper, Goizueta Business School (2006).↩

- Pomorski, Lukasz. “Acting on the Most Valuable Information:’Best Idea’ Trades of Mutual Fund Managers.” Available at SSRN 1108186 (2009)↩

- Nofsinger, John R, and Richard W Sias. “Herding and feedback trading by institutional and individual investors.” The Journal of Finance 54.6 (1999): 2263-2295.)↩

- Sias, Richard W, Laura T Starks, and Sheridan Titman. “Changes in Institutional Ownership and Stock Returns: Assessment and Methodology*.” The Journal of Business 79.6 (2006): 2869-2910.↩

- Chen, Desai. “A first look at Mutual Funds that use Short Sales” 17th Jan, 2012.↩

- Boehmer, Ekkehart, Zsuzsa R Huszar, and Bradford D Jordan. “The good news in short interest.” Journal of Financial Economics 96.1 (2010): 80-97.↩

- Ben Edelman. “The Darker Side of Blinkx” 2014. 25 Feb. 2014↩

- Asquith, Paul, Parag A Pathak, and Jay R Ritter. “Short interest, institutional ownership, and stock returns.” Journal of Financial Economics 78.2 (2005): 243-276.↩

- Drake, Michael S, Lynn Rees, and Edward P Swanson. “Should investors follow the prophets or the bears?” The Accounting Review 86.1 (2011): 101-130.↩

- Xu, Liu. “Short Squeezes” Aug. 2013.↩